* DECEMBER 31, 2008

"The 'Market' Isn't So Wise After All

This year saw the end of an illusion"

by Thomas Frank

As I read the last tranche of disastrous news stories from this catastrophic year, I found myself thinking back to the old days when it all seemed to work, when everyone agreed what made an economy go and the stock market raced and the commentators and economists and politicians of the world stood as one under the boldly soaring banner of laissez-faire.

In particular, I remembered that quintessential work of market triumphalism, "The Lexus and the Olive Tree," by New York Times columnist Thomas Friedman. It was published in the glorious year 1999, and in those days, it seemed, every cliché was made of gold: the brokerage advertisements were pithy, the small investors were mighty, and the deregulated way was irresistibly becoming the global way.

In one anecdote, Mr. Friedman described a visit to India by a team from Moody's Investor Service, a company that carried the awesome task of determining "who is pursuing sound economics and who is not." This was shortly after India had tested its nuclear weapons, and the idea was that such a traditional bid for power counted for little in this globalized age; what mattered was making political choices of which the market approved, with organizations like Moody's sifting out the hearts of nations before its judgment seat. In the end, Moody's "downgraded India's economy," according to Mr. Friedman, because it disapproved of India's politics.

The Opinion Journal Widget

Download Opinion Journal's widget and link to the most important editorials and op-eds of the day from your blog or Web page.

And who makes sure that Moody's and its competitors downgrade what deserves to be downgraded? In 1999 the obvious answer would have been: the market, with its fantastic self-regulating powers.

But something went wrong on the road to privatopia. If everything is for sale, why shouldn't the guardians put themselves on the block as well? Now we find that the profit motive, unleashed to work its magic within the credit-rating agencies, apparently exposed them to pressure from debt issuers and led them to give high ratings to the mortgage-backed securities that eventually blew the economy to pieces.

And so it has gone with many other shibboleths of the free-market consensus in this tragic year.

For example, it was only a short while ago that simply everyone knew deregulation to be the path to prosperity as well as the distilled essence of human freedom. Today, though, it seems this folly permitted a 100-year flood of fraud. Consider the Office of Thrift Supervision (OTS), the subject of a withering examination in the Washington Post last month. As part of what the Post called the "aggressively deregulatory stance" the OTS adopted toward the savings and loan industry in the years of George W. Bush, it slashed staff, rolled back enforcement, and came to regard the industry it was supposed to oversee as its "customers." Maybe it's only a coincidence that some of the biggest banks -- Washington Mutual and IndyMac -- ever to fail were regulated by that agency, but I doubt it.

Or consider the theory, once possible to proffer with a straight face, that lavishing princely bonuses and stock options on top management was a good idea since they drew executives' interests into happy alignment with those of the shareholders. Instead, CEOs were only too happy to gorge themselves and turn shareholders into bag holders. In the subprime mortgage industry, bankers handed out iffy loans like candy at a parade because such loans meant revenue and, hence, bonuses for executives in the here-and-now. The consequences would be borne down the line by the suckers who bought mortgage-backed securities. And, of course, by the shareholders.

At Washington Mutual, the bank that became most famous for open-handed lending, incentives lined the road to hell. According to the New York Times, realtors received fees from the bank for bringing in clients, mortgage brokers got "handsome commissions for selling the riskiest loans," and the CEO raked in $88 million from 2001 to 2007, before the outrageous risks of the scheme cratered the entire enterprise.

Today we stand at the end of a long historical stretch in which laissez-faire was glorified as gospel and the business community got almost its entire wish list granted by the state. To show its gratitude, the finance industry then stampeded us all over a cliff.

To be sure, some of the preachers of the old-time religion now admit the error of their ways. Especially remarkable is Alan Greenspan's confession of "shocked disbelief" on discovering how reality differed from holy writ.

But by and large the free-market medicine men seem determined to learn nothing from this awful year. Instead they repeat their incantations and retreat deeper into their dogma, generating endless schemes in which government is to blame, all sin originates with the Community Reinvestment Act, and the bailouts for which their own flock is desperately bleating can do nothing but harm.

And they wait for things to return to normal, without realizing that things already have.

Write to thomas@wsj.com

Wednesday, December 31, 2008

Wednesday, December 17, 2008

The Moral of the Story: Wall Street Crap Shoots

latimes.com

From the Los Angeles Times

Opinion

The moral of Madoff's tale

The alleged $50-billion swindle shows that this country's financial deregulation has failed.

Tim Rutten

December 17, 2008

In one of his more melancholy moods, Isaac Newton mused that he could measure the movement of distant celestial bodies but could not gauge the magnitude of human folly.

It's a reflection with a certain compelling relevance given the stunning news that one of the country's most respected securities traders, Bernard L. Madoff, allegedly has swindled investors out of at least $50 billion. It's a staggering sum, one that approaches the ghastly totals rolled up by such epochal corporate frauds as Enron and Worldcom. More staggering yet is the roster of victims, which includes not only banks but high-flying hedge funds, professional investors such as Mortimer Zuckerman, cultural luminaries such as Elie Wiesel and Steven Spielberg, an Orthodox Jewish school and a variety of other charitable foundations.

Madoff, moreover, was not some brash outsider. For nearly half a century, he and the firm he founded have been pillars of Wall Street. He and his brother helped create NASDAQ and helped lead the securities trading industry's transformative conversion to electronic trading.

Robert Graves dismissively quipped that while there is no money in poetry, neither is there poetry in money. As we've all recently learned, there sometimes is the stuff of other literary genres: farce and tragedy. There's a little of each in the proud declaration that was featured on the website Madoff's firm maintained:

"In an era of faceless organizations owned by other equally faceless organizations, Bernard L. Madoff Investment Securities LLC harks back to an earlier era in the financial world: The owner's name is on the door. Clients know that Bernard Madoff has a personal interest in maintaining the unblemished record of value, fair-dealing and high ethical standards that has always been the firm's hallmark."

In retrospect, it's a sentiment that brings to mind not Graves but Groucho -- "The secret to life is honesty and fair dealing. If you can fake that, you've got it made." The breathtaking hypocrisy of publishing such a declaration suggests a lesson to be learned, and a mystery to be pondered.

The lesson is one that becomes clearer with each excruciating turn of the Wall Street screw. The long, bipartisan experiment with financial deregulation has failed utterly. The argument that a return to rigorous oversight will somehow stifle Wall Street's "creativity" is no longer convincing. Whatever its theoretical costs, regulation is dramatically cheaper than intervention. And absolutist insistence on the superiority of "individual choice" and "free markets" now is exposed as so much vacant rhetoric.

Any system that permits a scam artist like Madoff to deceive not just widows and orphans but also sophisticated investors, like Fairfield Greenwich Group's Walter Noel and Hollywood's Jeffrey Katzenberg, isn't a market at all; it's a shooting gallery. We need, moreover, to re-regulate our securities markets because, if we don't, foreign investors -- like the European banks Madoff conned -- simply will walk away from Wall Street, an exodus that will fatally undermine America's position in the globalized financial system.

Then there's the mystery. How could so many sophisticated investors and people dazzlingly accomplished in their own fields allow themselves to be deceived in this way? Partly, of course, it's a matter in many cases of bad advice; partly, it's another example of falling for what might be called "the smartest guy in the room" fallacy. That was the underlying principle of Enron's con. You create a smoke screen of impenetrable complexity around your operations and call it brilliant innovation. So long as you go on delivering bankable returns that can't have any other honest explanation, some people -- even sophisticated ones -- simply will assume that it's because you're smarter than everybody else.

Madoff's fund purportedly relied on a complex trading strategy, executed according to a supposedly proprietary algorithm. The truth about Wall Street, however, isn't that dissimilar from what writer William Goldman once said about Hollywood -- when it comes to what works or doesn't work, nobody knows anything. When it comes to finance and investing, nobody is that much smarter than all the other smart guys.

So why do people insist on believing otherwise? That brings us back to Newton. Con men fatten not so much on their own talent for deceit as on their victims' penchant for self-deception. Sadly, the world's Bernie Madoffs will be with us for as long as some people believe that good fortune has inexplicably handed them an exemption from the laws of gravity -- that, for them, what goes up must not necessarily come down.

timothy.rutten@latimes.com

From the Los Angeles Times

Opinion

The moral of Madoff's tale

The alleged $50-billion swindle shows that this country's financial deregulation has failed.

Tim Rutten

December 17, 2008

In one of his more melancholy moods, Isaac Newton mused that he could measure the movement of distant celestial bodies but could not gauge the magnitude of human folly.

It's a reflection with a certain compelling relevance given the stunning news that one of the country's most respected securities traders, Bernard L. Madoff, allegedly has swindled investors out of at least $50 billion. It's a staggering sum, one that approaches the ghastly totals rolled up by such epochal corporate frauds as Enron and Worldcom. More staggering yet is the roster of victims, which includes not only banks but high-flying hedge funds, professional investors such as Mortimer Zuckerman, cultural luminaries such as Elie Wiesel and Steven Spielberg, an Orthodox Jewish school and a variety of other charitable foundations.

Madoff, moreover, was not some brash outsider. For nearly half a century, he and the firm he founded have been pillars of Wall Street. He and his brother helped create NASDAQ and helped lead the securities trading industry's transformative conversion to electronic trading.

Robert Graves dismissively quipped that while there is no money in poetry, neither is there poetry in money. As we've all recently learned, there sometimes is the stuff of other literary genres: farce and tragedy. There's a little of each in the proud declaration that was featured on the website Madoff's firm maintained:

"In an era of faceless organizations owned by other equally faceless organizations, Bernard L. Madoff Investment Securities LLC harks back to an earlier era in the financial world: The owner's name is on the door. Clients know that Bernard Madoff has a personal interest in maintaining the unblemished record of value, fair-dealing and high ethical standards that has always been the firm's hallmark."

In retrospect, it's a sentiment that brings to mind not Graves but Groucho -- "The secret to life is honesty and fair dealing. If you can fake that, you've got it made." The breathtaking hypocrisy of publishing such a declaration suggests a lesson to be learned, and a mystery to be pondered.

The lesson is one that becomes clearer with each excruciating turn of the Wall Street screw. The long, bipartisan experiment with financial deregulation has failed utterly. The argument that a return to rigorous oversight will somehow stifle Wall Street's "creativity" is no longer convincing. Whatever its theoretical costs, regulation is dramatically cheaper than intervention. And absolutist insistence on the superiority of "individual choice" and "free markets" now is exposed as so much vacant rhetoric.

Any system that permits a scam artist like Madoff to deceive not just widows and orphans but also sophisticated investors, like Fairfield Greenwich Group's Walter Noel and Hollywood's Jeffrey Katzenberg, isn't a market at all; it's a shooting gallery. We need, moreover, to re-regulate our securities markets because, if we don't, foreign investors -- like the European banks Madoff conned -- simply will walk away from Wall Street, an exodus that will fatally undermine America's position in the globalized financial system.

Then there's the mystery. How could so many sophisticated investors and people dazzlingly accomplished in their own fields allow themselves to be deceived in this way? Partly, of course, it's a matter in many cases of bad advice; partly, it's another example of falling for what might be called "the smartest guy in the room" fallacy. That was the underlying principle of Enron's con. You create a smoke screen of impenetrable complexity around your operations and call it brilliant innovation. So long as you go on delivering bankable returns that can't have any other honest explanation, some people -- even sophisticated ones -- simply will assume that it's because you're smarter than everybody else.

Madoff's fund purportedly relied on a complex trading strategy, executed according to a supposedly proprietary algorithm. The truth about Wall Street, however, isn't that dissimilar from what writer William Goldman once said about Hollywood -- when it comes to what works or doesn't work, nobody knows anything. When it comes to finance and investing, nobody is that much smarter than all the other smart guys.

So why do people insist on believing otherwise? That brings us back to Newton. Con men fatten not so much on their own talent for deceit as on their victims' penchant for self-deception. Sadly, the world's Bernie Madoffs will be with us for as long as some people believe that good fortune has inexplicably handed them an exemption from the laws of gravity -- that, for them, what goes up must not necessarily come down.

timothy.rutten@latimes.com

Tuesday, December 02, 2008

Why Wall Street Always Blows It

December 2008

The magnitude of the current bust seems almost unfathomable—and it was unfathomable, to even the most sophisticated financial professionals, until the moment the bubble popped. How could this happen? And what's to stop it from happening again? A former Wall Street insider explains how the financial industry got it so badly wrong, why it always will—and why all of us are to blame.

by Henry Blodget

Why Wall Street Always Blows It

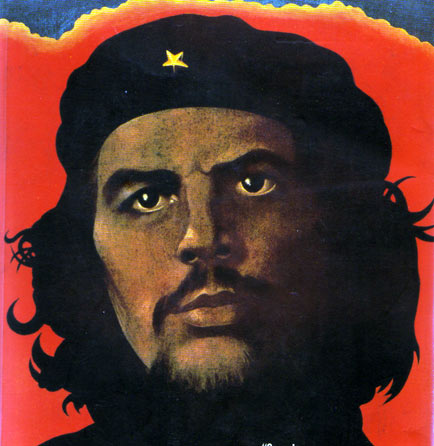

Image credit: John Ritter

Well, we did it again. Only eight years after the last big financial boom ended in disaster, we’re now in the migraine hangover of an even bigger one—a global housing and debt bubble whose bursting has wiped out tens of trillions of dollars of wealth and brought the world to the edge of a second Great Depression.

Millions have lost their houses. Millions more have lost their retirement savings. Tens of millions have had their portfolios smashed. And the carnage in the “real economy” has only just begun.

What the hell happened? After decades of increasing financial sophistication, weren’t we supposed to be done with these things? Weren’t we supposed to know better?

Yes, of course. Every time this happens, we think it will be the last time. But it never will be.

First things first: for better and worse, I have had more professional experience with financial bubbles than I would ever wish on anyone. During the dot-com episode, as you may unfortunately recall, I was a famous tech-stock analyst at Merrill Lynch. I was famous because I was on the right side of the boom through the late 1990s, when stocks were storming to record-high prices every year—Internet stocks, especially. By late 1998, I was cautioning clients that “what looks like a bubble probably is,” but this didn’t save me. Fifteen months later, I missed the top and drove my clients right over the cliff.

Later, in the smoldering aftermath, as you may also unfortunately recall, I was accused by Eliot Spitzer, then New York’s attorney general, of having hung on too long in order to curry favor with the companies I was analyzing, some of which were also Merrill banking clients. This allegation led to my banishment from the industry, though it didn’t explain why I had followed my own advice and blown my own portfolio to smithereens (more on this later).

I experienced the next bubble differently—as a journalist and homeowner. Having already learned the most obvious lesson about bubbles, which is that you don’t want to get out too late, I now discovered something nearly as obvious: you don’t want to get out too early. Figuring that the roaring housing market was just another tech-stock bubble in the making, I rushed to sell my house in 2003—only to watch its price nearly double over the next three years. I also predicted the demise of the Manhattan real-estate market on the cover of New York magazine in 2005. Prices are finally falling now, in 2008, but they’re still well above where they were then.

Live through enough bubbles, though, and you do eventually learn something of value. For example, I’ve learned that although getting out too early hurts, it hurts less than getting out too late. More important, I’ve learned that most of the common wisdom about financial bubbles is wrong.

Who’s to blame for the current crisis? As usually happens after a crash, the search for scapegoats has been intense, and many contenders have emerged: Wall Street swindled us; predatory lenders sold us loans we couldn’t afford; the Securities and Exchange Commission fell asleep at the switch; Alan Greenspan kept interest rates low for too long; short-sellers spread negative rumors; “experts” gave us bad advice. More-introspective folks will add other explanations: we got greedy; we went nuts; we heard what we wanted to hear.

All of these explanations have some truth to them. Predatory lenders did bamboozle some people into loans and houses they couldn’t afford. The SEC and other regulators did miss opportunities to curb some of the more egregious behavior. Alan Greenspan did keep interest rates too low for too long (and if you’re looking for the single biggest cause of the housing bubble, this is it). Some short-sellers did spread negative rumors. And, Lord knows, many of us got greedy, checked our brains at the door, and heard what we wanted to hear.

But most bubbles are the product of more than just bad faith, or incompetence, or rank stupidity; the interaction of human psychology with a market economy practically ensures that they will form. In this sense, bubbles are perfectly rational—or at least they’re a rational and unavoidable by-product of capitalism (which, as Winston Churchill might have said, is the worst economic system on the planet except for all the others). Technology and circumstances change, but the human animal doesn’t. And markets are ultimately about people.

To understand why bubble participants make the decisions they do, let’s roll back the clock to 2002. The stock-market crash has crushed our portfolios and left us feeling vulnerable, foolish, and poor. We’re not wiped out, thankfully, but we’re chastened, and we’re certainly not going to go blow our extra money on Cisco Systems again. So where should we put it? What’s safe? How about a house?

House prices, we are told by our helpful neighborhood real-estate agent, almost never go down. This sounds right, and they certainly didn’t go down in the stock-market crash. In fact, for as long as we can remember—about 10 years, in most cases—house prices haven’t gone down. (Wait, maybe there was a slight dip, after the 1987 stock-market crash, but looming larger in our memories is what’s happened since; everyone we know who’s bought a house since the early 1990s has made gobs of money.)

We consider following our agent’s advice, but then we decide against it. House prices have doubled since the mid-1990s; we’re not going to get burned again by buying at the top. So we decide to just stay in our rent-stabilized rabbit warren and wait for house prices to collapse.

Unfortunately, they don’t. A year later, they’ve risen at least another 10 percent. By 2006, we’re walking past neighborhood houses that we could have bought for about half as much four years ago; we wave to happy new neighbors who are already deep in the money. One neighbor has “unlocked the value in his house” by taking out a cheap home-equity loan, and he’s using the proceeds to build a swimming pool. He is also doing well, along with two visionary friends, by buying and flipping other houses—so well, in fact, that he’s considering quitting his job and becoming a full-time real-estate developer. After four years of resistance, we finally concede—houses might be a good investment after all—and call our neighborhood real-estate agent. She’s jammed (and driving a new BMW), but she agrees to fit us in.

We see five houses: two were on the market two years ago for 30 percent less (we just can’t handle the pain of that); two are dumps; and the fifth, which we love, is listed at a positively ridiculous price. The agent tells us to hurry—if we don’t bid now, we’ll lose the house. But we’re still hesitant: last week, we read an article in which some economist was predicting a housing crash, and that made us nervous. (Our agent counters that Greenspan says the housing market’s in good shape, and he isn’t known as “The Maestro” for nothing.)

When we get home, we call our neighborhood mortgage broker, who gives us a surprisingly reasonable quote—with a surprisingly small down payment. It’s a new kind of loan, he says, called an adjustable-rate mortgage, which is the same kind our neighbor has. The payments will “reset” in three years, but, as the mortgage broker suggests, we’ll probably have moved up to a bigger house by then. We discuss the house during dinner and breakfast. We review our finances to make sure we can afford it. Then, the next afternoon, we call the agent to place a bid. And the house is already gone—at 10 percent above the asking price.

By the spring of 2007, we’ve finally caught up to the market reality, and our luck finally changes: We make an instant, aggressive bid on a huge house, with almost no money down. And we get it! We’re finally members of the ownership society.

You know the rest. Eighteen months later, our down payment has been wiped out and we owe more on the house than it’s worth. We’re still able to make the payments, but our mortgage rate is about to reset. And we’ve already heard rumors about coming layoffs at our jobs. How on Earth did we get into this mess?

The exact answer is different in every case, of course. But let’s round up the usual suspects:

• The predatory mortgage broker? Well, we’re certainly not happy with the bastard, given that he sold us a loan that is now a ticking time bomb. But we did ask him to show us a range of options, and he didn’t make us pick this one. We picked it because it had the lowest payment.

• Our sleazy real-estate agent? We’re not speaking to her anymore, either (and we’re secretly stoked that her BMW just got repossessed), but again, she didn’t lie to us. She just kept saying that houses are usually a good investment. And she is, after all, a saleswoman; that was never very hard to figure out.

• Wall Street fat cats? Boy, do we hate those guys, especially now that our tax dollars are bailing them out. But we didn’t complain when our lender asked for such a small down payment without bothering to check how much money we made. At the time, we thought that was pretty great.

• The SEC? We’re furious that our government let this happen to us, and we’re sure someone is to blame. We’re not really sure who that someone is, though. Whoever is responsible for making sure that something like this never happens to us, we guess.

• Alan “The Maestro” Greenspan? We’re pissed at him too. If he hadn’t been out there saying everything was fine, we might have believed that economist who said it wasn’t.

• Bad advice? Hell, yes, we got bad advice. Our real-estate agent. That mortgage guy. Our neighbor. Greenspan. The media. They all gave us horrendous advice. We should have just waited for the market to crash. But everyone said it was different this time.

Still, except in cases involving outright fraud—a small minority—the buck stops with us. Not knowing that the market would crash isn’t an excuse. No one knew the market would crash, even the analysts who predicted that it would. (Just as important, no one knew when prices would go down, or how fast.) And for years, most of the skeptics looked—and felt—like fools.

Everyone else on that list above bears some responsibility too. But in the case I have described, it would be hard to say that any of them acted criminally. Or irrationally. Or even irresponsibly. In fact, almost everyone on that list acted just the way you would expect them to act under the circumstances.

That’s especially true for the professionals on Wall Street, who’ve come in for more criticism than anyone in recent months, and understandably so. It was Wall Street, after all, that chose not only to feed the housing bubble, but ultimately to bet so heavily on it as to put the entire financial system at risk. How did the experts who are paid to obsess about the direction of the market—allegedly the most financially sophisticated among us—get it so badly wrong? The answer is that the typical financial professional is a lot more like our hypothetical home buyer than anyone on Wall Street would care to admit. Given the intersection of experience, uncertainty, and self-interest within the finance industry, it should be no surprise that Wall Street blew it—or that it will do so again.

Take experience (or the lack thereof). Boom-and-bust cycles like the one we just went through take a long time to complete. The really big busts, in fact, the ones that affect the whole market and economy, are usually separated by more than 30 years—think 1929, 1966, and 2000. (Why did the housing bubble follow the tech bubble so closely? Because both were really just parts of a larger credit bubble, which had been building since the late 1980s. That bubble didn’t deflate after the 2000 crash, in part thanks to Greenspan’s attempts to save the economy.) By the time the next Great Bubble rolls around, a lot of us will be as dead and gone as Richard Whitney, Jesse Livermore, Charles Mitchell, and the other giants of the 1929 crash. (Never heard of them? Exactly.)

Since Wall Street replenishes itself with a new crop of fresh faces every year—many of the professionals at the elite firms either flame out or retire by age 40—most of the industry doesn’t usually have experience with both booms and busts. In the 1990s, I and thousands of young Wall Street analysts and investors like me hadn’t seen anything but a 15-year bull market. The only market shocks that we knew much about—the 1987 crash, say, or Mexico’s 1994 financial crisis—had immediately been followed by strong recoveries (and exhortations to “buy the dip”).

By 1996, when Greenspan made his famous “irrational exuberance” remark, the stock market’s valuation was nearing its peak from prior bull markets, making some veteran investors nervous. Over the next few years, however, despite confident predictions of doom, stocks just kept going up. And eventually, inevitably, this led to assertions that no peak was in sight, much less a crash—you see, it was “different this time.”

Those are said to be the most expensive words in the English language, by the way: it’s different this time. You can’t have a bubble without good explanations for why it’s different this time. If everyone knew that this time wasn’t different, the market would stop going up. But the future is always uncertain—and amid uncertainty, all sorts of faith-based theories can flourish, even on Wall Street.

In the 1920s, the “differences” were said to be the miraculous new technologies (phones, cars, planes) that would speed the economy, as well as Prohibition, which was supposed to produce an ultra-efficient, ultra-responsible workforce. (Don’t laugh: one of the most respected economists of the era, Irving Fisher of Yale University, believed that one.) In the tech bubble of the 1990s, the differences were low interest rates, low inflation, a government budget surplus, the Internet revolution, and a Federal Reserve chairman apparently so divinely talented that he had made the business cycle obsolete. In the housing bubble, they were low interest rates, population growth, new mortgage products, a new ownership society, and, of course, the fact that “they aren’t making any more land.”

In hindsight, it’s obvious that all these differences were bogus (they’ve never made any more land—except in Dubai, which now has its own problems). At the time, however, with prices going up every day, things sure seemed different.

In fairness to the thousands of experts who’ve snookered themselves throughout the years, a complicating factor is always at work: the ever-present possibility that it really might have been different. Everything is obvious only after the crash.

Consider, for instance, the late 1950s, when a tried-and-true “sell signal” started flashing on Wall Street. For the first time in years, stock prices had risen so high that the dividend yield on stocks had fallen below the coupon yield on bonds. To anyone who had been around for a while, this seemed ridiculous: stocks are riskier than bonds, so a rational buyer must be paid more to own them. Wise, experienced investors sold their stocks and waited for this obvious mispricing to correct itself. They’re still waiting.

Why? Because that time, it was different. There were increasing concerns about inflation, which erodes the value of fixed bond-interest payments. Stocks offer more protection against inflation, so their value relative to bonds had increased. By the time the prudent folks who sold their stocks figured this out, however, they’d missed out on many years of a raging bull market.

When I was on Wall Street, the embryonic Internet sector was different, of course—at least to those of us who were used to buying staid, steady stocks that went up 10 percent in a good year. Most Internet companies didn’t have earnings, and some of them barely had revenue. But the performance of some of their stocks was spectacular.

In 1997, I recommended that my clients buy stock in a company called Yahoo; the stock finished the year up more than 500 percent. The next year, I put a $400-a-share price target on a controversial “online bookseller” called Amazon, worth about $240 a share at the time; within a month, the stock blasted through $400 en route to $600. You don’t have to make too many calls like these before people start listening to you; I soon had a global audience keenly interested in whatever I said.

One of the things I said frequently, especially after my Amazon prediction, was that the tech sector’s stock behavior sure looked like a bubble. At the end of 1998, in fact, I published a report called “Surviving (and Profiting From) Bubble.com,” in which I listed similarities between the dot-com phenomenon and previous boom-and-bust cycles in biotech, personal computers, and other sectors. But I recommended that my clients own a few high-quality Internet stocks anyway—because of the ways in which I thought the Internet was different. I won’t spell out all those ways, but I will say that they sounded less stupid then than they do now.

The bottom line is that resisting the siren call of a boom is much easier when you have already been obliterated by one. In the late 1990s, as stocks kept roaring higher, it got easier and easier to believe that something really was different. So, in early 2000, weeks before the bubble burst, I put a lot of money where my mouth was. Two years later, I had lost the equivalent of six high-end college educations.

Of course, as Eliot Spitzer and others would later observe—and as was crystal clear to most Wall Street executives at the time—being bullish in a bull market is undeniably good for business. When the market is rising, no one wants to work with a bear.

Which brings us to the last major contributor to booms and busts: self-interest.

When people look back on bubbles, many conclude that the participants must have gone stark raving mad. In most cases, nothing could be further from the truth.

In my example from the housing boom, for instance, each participant’s job was not to predict what the housing market would do but to accomplish a more concrete aim. The buyer wanted to buy a house; the real-estate agent wanted to earn a commission; the mortgage broker wanted to sell a loan; Wall Street wanted to buy loans so it could package and resell them as “mortgage-backed securities”; Alan Greenspan wanted to keep American prosperity alive; members of Congress wanted to get reelected. None of these participants, it is important to note, was paid to predict the likely future movements of the housing market. In every case (except, perhaps, the buyer’s), that was, at best, a minor concern.

This does not make the participants villains or morons. It does, however, illustrate another critical component of boom-time decision-making: the difference between investment risk and career or business risk.

Professional fund managers are paid to manage money for their clients. Most managers succeed or fail based not on how much money they make or lose but on how much they make or lose relative to the market and other fund managers.

If the market goes up 20 percent and your Fidelity fund goes up only 10 percent, for example, you probably won’t call Fidelity and say, “Thank you.” Instead, you’ll probably call and say, “What am I paying you people for, anyway?” (Or at least that’s what a lot of investors do.) And if this performance continues for a while, you might eventually fire Fidelity and hire a new fund manager.

On the other hand, if your Fidelity fund declines in value but the market drops even more, you’ll probably stick with the fund for a while (“Hey, at least I didn’t lose as much as all those suckers in index funds”). That is, until the market drops so much that you can’t take it anymore and you sell everything, which is what a lot of people did in October, when the Dow plunged below 9,000.

In the money-management business, therefore, investment risk is the risk that your bets will cost your clients money. Career or business risk, meanwhile, is the risk that your bets will cost you or your firm money or clients.

The tension between investment risk and business risk often leads fund managers to make decisions that, to outsiders, seem bizarre. From the fund managers’ perspective, however, they’re perfectly rational.

In the late 1990s, while I was trying to figure out whether it was different this time, some of the most legendary fund managers in the industry were struggling. Since 1995, any fund managers who had been bearish had not been viewed as “wise” or “prudent”; they had been viewed as “wrong.” And because being wrong meant underperforming, many had been shown the door.

It doesn’t take very many of these firings to wake other financial professionals up to the fact that being bearish and wrong is at least as risky as being bullish and wrong. The ultimate judge of who is “right” and “wrong” on Wall Street, moreover, is the market, which posts its verdict day after day, month after month, year after year. So over time, in a long bull market, most of the bears get weeded out, through either attrition or capitulation.

By mid-1999, with mountains of money being made in tech stocks, fund owners were more impatient than ever: their friends were getting rich in Cisco, so their fund manager had better own Cisco—or he or she was an idiot. And if the fund manager thought Cisco was overvalued and was eventually going to crash? Well, in those years, fund managers usually approached this type of problem in of one of three ways: they refused to play; they played and tried to win; or they split the difference.

In the first camp was an iconic hedge-fund manager named Julian Robertson. For almost two decades, Robertson’s Tiger Management had racked up annual gains of about 30 percent by, as he put it, buying the best stocks and shorting the worst. (One of the worst, in Robertson’s opinion, was Amazon, and he used to summon me to his office and demand to know why everyone else kept buying it.)

By 1998, Robertson was short Amazon and other tech stocks, and by 2000, after the NASDAQ had jumped an astounding 86 percent the previous year, Robertson’s business and reputation had been mauled. Thanks to poor performance and investor withdrawals, Tiger’s assets under management had collapsed from about $20billion to about $6billion, and the firm’s revenues had collapsed as well. Robertson refused to change his stance, however, and in the spring of 2000, he threw in the towel: he closed Tiger’s doors and began returning what was left of his investors’ money.

Across town, meanwhile, at Soros Fund Management, a similar struggle was taking place, with another titanic fund manager’s reputation on the line. In 1998, the firm had gotten crushed as a result of its bets against technology stocks (among other reasons). Midway through 1999, however, the manager of Soros’s Quantum Fund, Stanley Druckenmiller, reversed that position and went long on technology. Why? Because unlike Robertson, Druckenmiller viewed it as his job to make money no matter what the market was doing, not to insist that the market was wrong.

At first, the bet worked: the reversal saved 1999 and got 2000 off to a good start. But by the end of April, Quantum was down a shocking 22 percent for the year, and Druckenmiller had resigned: “We thought it was the eighth inning, and it was the ninth.”

Robertson and Druckenmiller stuck to their guns and played the extremes (and lost). Another fund manager, a man I’ll call the Pragmatist, split the difference.

The Pragmatist had owned tech stocks for most of the 1990s, and their spectacular performance had made his fund famous and his firm rich. By mid-1999, however, the Pragmatist had seen a bust in the making and begun selling tech, so his fund had started to underperform. Just one quarter later, his boss, tired of watching assets flow out the door, suggested that the Pragmatist reconsider his position on tech. A quarter after that, his boss made it simpler for him: buy tech, or you’re fired.

The Pragmatist thought about quitting. But he knew what would happen if he did: his boss would hire a 25-year-old gunslinger who would immediately load up the fund with tech stocks. The Pragmatist also thought about refusing to follow the order. But that would mean he would be fired for cause (no severance or bonus), and his boss would hire the same 25-year-old gunslinger.

In the end, the Pragmatist compromised. He bought enough tech stocks to pacify his boss but not enough to entirely wipe out his fund holders if the tech bubble popped. A few months later, when the market crashed and the fund got hammered, he took his bonus and left the firm.

This tension between investment risk and career or business risk comes into play in other areas of Wall Street too. It was at the center of the decisions made in the past few years by half a dozen seemingly brilliant CEOs whose firms no longer exist.

Why did Bear Stearns, Lehman Brothers, Fannie Mae, Freddie Mac, AIG, and the rest of an ever-growing Wall Street hall of shame take so much risk that they ended up blowing their firms to kingdom come? Because in a bull market, when you borrow and bet $30 for every $1 you have in capital, as many firms did, you can do mind-bogglingly well. And when your competitors are betting the same $30 for every $1, and your shareholders are demanding that you do better, and your bonus is tied to how much money your firm makes—not over the long term, but this year, before December 31—the downside to refusing to ride the bull market comes into sharp relief. And when naysayers have been so wrong for so long, and your risk-management people assure you that you’re in good shape unless we have another Great Depression (which we won’t, of course, because it’s different this time), well, you can easily convince yourself that disaster is a possibility so remote that it’s not even worth thinking about.

It’s easy to lay the destruction of Wall Street at the feet of the CEOs and directors, and the bulk of the responsibility does lie with them. But some of it lies with shareholders and the whole model of public ownership. Wall Street never has been—and likely never will be—paid primarily for capital preservation. However, in the days when Wall Street firms were funded primarily by capital contributed by individual partners, preserving that capital in the long run was understandably a higher priority than it is today. Now Wall Street firms are primarily owned not by partners with personal capital at risk but by demanding institutional shareholders examining short-term results. When your fiduciary duty is to manage the firm for the benefit of your shareholders, you can easily persuade yourself that you’re just balancing risk and reward—when what you’re really doing is betting the firm.

As we work our way through the wreckage of this latest colossal bust, our government—at our urging—will go to great lengths to try to make sure such a bust never happens again. We will “fix” the “problems” that we decide caused the debacle; we will create new regulatory requirements and systems; we will throw a lot of people in jail. We will do whatever we must to assure ourselves that it will be different next time. And as long as the searing memory of this disaster is fresh in the public mind, it will be different. But as the bust recedes into the past, our priorities will slowly change, and we will begin to set ourselves up for the next great boom.

A few decades hence, when the Great Crash of 2008 is a distant memory and the economy is humming along again, our government—at our urging—will begin to weaken many of the regulatory requirements and systems we put in place now. Why? To make our economy more competitive and to unleash the power of our free-market system. We will tell ourselves it’s different, and in many ways, it will be. But the cycle will start all over again.

So what can we learn from all this? In the words of the great investor Jeremy Grantham, who saw this collapse coming and has seen just about everything else in his four-decade career: “We will learn an enormous amount in a very short time, quite a bit in the medium term, and absolutely nothing in the long term.” Of course, to paraphrase Keynes, in the long term, you and I will be dead. Until that time comes, here are three thoughts I hope we all can keep in mind.

First, bubbles are to free-market capitalism as hurricanes are to weather: regular, natural, and unavoidable. They have happened since the dawn of economic history, and they’ll keep happening for as long as humans walk the Earth, no matter how we try to stop them. We can’t legislate away the business cycle, just as we can’t eliminate the self-interest that makes the whole capitalist system work. We would do ourselves a favor if we stopped pretending we can.

Second, bubbles and their aftermaths aren’t all bad: the tech and Internet bubble, for example, helped fund the development of a global medium that will eventually be as central to society as electricity. Likewise, the latest bust will almost certainly lead to a smaller, poorer financial industry, meaning that many talented workers will go instead into other careers—that’s probably a healthy rebalancing for the economy as a whole. The current bust will also lead to at least some regulatory improvements that endure; the carnage of 1933, for example, gave rise to many of our securities laws and to the SEC, without which this bust would have been worse.

Lastly, we who have had the misfortune of learning firsthand from this experience—and in a bust this big, that group includes just about everyone—can take pains to make sure that we, personally, never make similar mistakes again. Specifically, we can save more, spend less, diversify our investments, and avoid buying things we can’t afford. Most of all, a few decades down the road, we can raise an eyebrow when our children explain that we really should get in on the new new new thing because, yes, it’s different this time.

The URL for this page is http://www.theatlantic.com/doc/200812/blodget-wall-street

SUBSCRIBE TO THE ATLANTIC TODAY!

Take advantage of our great rate to subscribe to a year of The Atlantic Monthly.

Go to the following Web address to sign up today:

The magnitude of the current bust seems almost unfathomable—and it was unfathomable, to even the most sophisticated financial professionals, until the moment the bubble popped. How could this happen? And what's to stop it from happening again? A former Wall Street insider explains how the financial industry got it so badly wrong, why it always will—and why all of us are to blame.

by Henry Blodget

Why Wall Street Always Blows It

Image credit: John Ritter

Well, we did it again. Only eight years after the last big financial boom ended in disaster, we’re now in the migraine hangover of an even bigger one—a global housing and debt bubble whose bursting has wiped out tens of trillions of dollars of wealth and brought the world to the edge of a second Great Depression.

Millions have lost their houses. Millions more have lost their retirement savings. Tens of millions have had their portfolios smashed. And the carnage in the “real economy” has only just begun.

What the hell happened? After decades of increasing financial sophistication, weren’t we supposed to be done with these things? Weren’t we supposed to know better?

Yes, of course. Every time this happens, we think it will be the last time. But it never will be.

First things first: for better and worse, I have had more professional experience with financial bubbles than I would ever wish on anyone. During the dot-com episode, as you may unfortunately recall, I was a famous tech-stock analyst at Merrill Lynch. I was famous because I was on the right side of the boom through the late 1990s, when stocks were storming to record-high prices every year—Internet stocks, especially. By late 1998, I was cautioning clients that “what looks like a bubble probably is,” but this didn’t save me. Fifteen months later, I missed the top and drove my clients right over the cliff.

Later, in the smoldering aftermath, as you may also unfortunately recall, I was accused by Eliot Spitzer, then New York’s attorney general, of having hung on too long in order to curry favor with the companies I was analyzing, some of which were also Merrill banking clients. This allegation led to my banishment from the industry, though it didn’t explain why I had followed my own advice and blown my own portfolio to smithereens (more on this later).

I experienced the next bubble differently—as a journalist and homeowner. Having already learned the most obvious lesson about bubbles, which is that you don’t want to get out too late, I now discovered something nearly as obvious: you don’t want to get out too early. Figuring that the roaring housing market was just another tech-stock bubble in the making, I rushed to sell my house in 2003—only to watch its price nearly double over the next three years. I also predicted the demise of the Manhattan real-estate market on the cover of New York magazine in 2005. Prices are finally falling now, in 2008, but they’re still well above where they were then.

Live through enough bubbles, though, and you do eventually learn something of value. For example, I’ve learned that although getting out too early hurts, it hurts less than getting out too late. More important, I’ve learned that most of the common wisdom about financial bubbles is wrong.

Who’s to blame for the current crisis? As usually happens after a crash, the search for scapegoats has been intense, and many contenders have emerged: Wall Street swindled us; predatory lenders sold us loans we couldn’t afford; the Securities and Exchange Commission fell asleep at the switch; Alan Greenspan kept interest rates low for too long; short-sellers spread negative rumors; “experts” gave us bad advice. More-introspective folks will add other explanations: we got greedy; we went nuts; we heard what we wanted to hear.

All of these explanations have some truth to them. Predatory lenders did bamboozle some people into loans and houses they couldn’t afford. The SEC and other regulators did miss opportunities to curb some of the more egregious behavior. Alan Greenspan did keep interest rates too low for too long (and if you’re looking for the single biggest cause of the housing bubble, this is it). Some short-sellers did spread negative rumors. And, Lord knows, many of us got greedy, checked our brains at the door, and heard what we wanted to hear.

But most bubbles are the product of more than just bad faith, or incompetence, or rank stupidity; the interaction of human psychology with a market economy practically ensures that they will form. In this sense, bubbles are perfectly rational—or at least they’re a rational and unavoidable by-product of capitalism (which, as Winston Churchill might have said, is the worst economic system on the planet except for all the others). Technology and circumstances change, but the human animal doesn’t. And markets are ultimately about people.

To understand why bubble participants make the decisions they do, let’s roll back the clock to 2002. The stock-market crash has crushed our portfolios and left us feeling vulnerable, foolish, and poor. We’re not wiped out, thankfully, but we’re chastened, and we’re certainly not going to go blow our extra money on Cisco Systems again. So where should we put it? What’s safe? How about a house?

House prices, we are told by our helpful neighborhood real-estate agent, almost never go down. This sounds right, and they certainly didn’t go down in the stock-market crash. In fact, for as long as we can remember—about 10 years, in most cases—house prices haven’t gone down. (Wait, maybe there was a slight dip, after the 1987 stock-market crash, but looming larger in our memories is what’s happened since; everyone we know who’s bought a house since the early 1990s has made gobs of money.)

We consider following our agent’s advice, but then we decide against it. House prices have doubled since the mid-1990s; we’re not going to get burned again by buying at the top. So we decide to just stay in our rent-stabilized rabbit warren and wait for house prices to collapse.

Unfortunately, they don’t. A year later, they’ve risen at least another 10 percent. By 2006, we’re walking past neighborhood houses that we could have bought for about half as much four years ago; we wave to happy new neighbors who are already deep in the money. One neighbor has “unlocked the value in his house” by taking out a cheap home-equity loan, and he’s using the proceeds to build a swimming pool. He is also doing well, along with two visionary friends, by buying and flipping other houses—so well, in fact, that he’s considering quitting his job and becoming a full-time real-estate developer. After four years of resistance, we finally concede—houses might be a good investment after all—and call our neighborhood real-estate agent. She’s jammed (and driving a new BMW), but she agrees to fit us in.

We see five houses: two were on the market two years ago for 30 percent less (we just can’t handle the pain of that); two are dumps; and the fifth, which we love, is listed at a positively ridiculous price. The agent tells us to hurry—if we don’t bid now, we’ll lose the house. But we’re still hesitant: last week, we read an article in which some economist was predicting a housing crash, and that made us nervous. (Our agent counters that Greenspan says the housing market’s in good shape, and he isn’t known as “The Maestro” for nothing.)

When we get home, we call our neighborhood mortgage broker, who gives us a surprisingly reasonable quote—with a surprisingly small down payment. It’s a new kind of loan, he says, called an adjustable-rate mortgage, which is the same kind our neighbor has. The payments will “reset” in three years, but, as the mortgage broker suggests, we’ll probably have moved up to a bigger house by then. We discuss the house during dinner and breakfast. We review our finances to make sure we can afford it. Then, the next afternoon, we call the agent to place a bid. And the house is already gone—at 10 percent above the asking price.

By the spring of 2007, we’ve finally caught up to the market reality, and our luck finally changes: We make an instant, aggressive bid on a huge house, with almost no money down. And we get it! We’re finally members of the ownership society.

You know the rest. Eighteen months later, our down payment has been wiped out and we owe more on the house than it’s worth. We’re still able to make the payments, but our mortgage rate is about to reset. And we’ve already heard rumors about coming layoffs at our jobs. How on Earth did we get into this mess?

The exact answer is different in every case, of course. But let’s round up the usual suspects:

• The predatory mortgage broker? Well, we’re certainly not happy with the bastard, given that he sold us a loan that is now a ticking time bomb. But we did ask him to show us a range of options, and he didn’t make us pick this one. We picked it because it had the lowest payment.

• Our sleazy real-estate agent? We’re not speaking to her anymore, either (and we’re secretly stoked that her BMW just got repossessed), but again, she didn’t lie to us. She just kept saying that houses are usually a good investment. And she is, after all, a saleswoman; that was never very hard to figure out.

• Wall Street fat cats? Boy, do we hate those guys, especially now that our tax dollars are bailing them out. But we didn’t complain when our lender asked for such a small down payment without bothering to check how much money we made. At the time, we thought that was pretty great.

• The SEC? We’re furious that our government let this happen to us, and we’re sure someone is to blame. We’re not really sure who that someone is, though. Whoever is responsible for making sure that something like this never happens to us, we guess.

• Alan “The Maestro” Greenspan? We’re pissed at him too. If he hadn’t been out there saying everything was fine, we might have believed that economist who said it wasn’t.

• Bad advice? Hell, yes, we got bad advice. Our real-estate agent. That mortgage guy. Our neighbor. Greenspan. The media. They all gave us horrendous advice. We should have just waited for the market to crash. But everyone said it was different this time.

Still, except in cases involving outright fraud—a small minority—the buck stops with us. Not knowing that the market would crash isn’t an excuse. No one knew the market would crash, even the analysts who predicted that it would. (Just as important, no one knew when prices would go down, or how fast.) And for years, most of the skeptics looked—and felt—like fools.

Everyone else on that list above bears some responsibility too. But in the case I have described, it would be hard to say that any of them acted criminally. Or irrationally. Or even irresponsibly. In fact, almost everyone on that list acted just the way you would expect them to act under the circumstances.

That’s especially true for the professionals on Wall Street, who’ve come in for more criticism than anyone in recent months, and understandably so. It was Wall Street, after all, that chose not only to feed the housing bubble, but ultimately to bet so heavily on it as to put the entire financial system at risk. How did the experts who are paid to obsess about the direction of the market—allegedly the most financially sophisticated among us—get it so badly wrong? The answer is that the typical financial professional is a lot more like our hypothetical home buyer than anyone on Wall Street would care to admit. Given the intersection of experience, uncertainty, and self-interest within the finance industry, it should be no surprise that Wall Street blew it—or that it will do so again.

Take experience (or the lack thereof). Boom-and-bust cycles like the one we just went through take a long time to complete. The really big busts, in fact, the ones that affect the whole market and economy, are usually separated by more than 30 years—think 1929, 1966, and 2000. (Why did the housing bubble follow the tech bubble so closely? Because both were really just parts of a larger credit bubble, which had been building since the late 1980s. That bubble didn’t deflate after the 2000 crash, in part thanks to Greenspan’s attempts to save the economy.) By the time the next Great Bubble rolls around, a lot of us will be as dead and gone as Richard Whitney, Jesse Livermore, Charles Mitchell, and the other giants of the 1929 crash. (Never heard of them? Exactly.)

Since Wall Street replenishes itself with a new crop of fresh faces every year—many of the professionals at the elite firms either flame out or retire by age 40—most of the industry doesn’t usually have experience with both booms and busts. In the 1990s, I and thousands of young Wall Street analysts and investors like me hadn’t seen anything but a 15-year bull market. The only market shocks that we knew much about—the 1987 crash, say, or Mexico’s 1994 financial crisis—had immediately been followed by strong recoveries (and exhortations to “buy the dip”).

By 1996, when Greenspan made his famous “irrational exuberance” remark, the stock market’s valuation was nearing its peak from prior bull markets, making some veteran investors nervous. Over the next few years, however, despite confident predictions of doom, stocks just kept going up. And eventually, inevitably, this led to assertions that no peak was in sight, much less a crash—you see, it was “different this time.”

Those are said to be the most expensive words in the English language, by the way: it’s different this time. You can’t have a bubble without good explanations for why it’s different this time. If everyone knew that this time wasn’t different, the market would stop going up. But the future is always uncertain—and amid uncertainty, all sorts of faith-based theories can flourish, even on Wall Street.

In the 1920s, the “differences” were said to be the miraculous new technologies (phones, cars, planes) that would speed the economy, as well as Prohibition, which was supposed to produce an ultra-efficient, ultra-responsible workforce. (Don’t laugh: one of the most respected economists of the era, Irving Fisher of Yale University, believed that one.) In the tech bubble of the 1990s, the differences were low interest rates, low inflation, a government budget surplus, the Internet revolution, and a Federal Reserve chairman apparently so divinely talented that he had made the business cycle obsolete. In the housing bubble, they were low interest rates, population growth, new mortgage products, a new ownership society, and, of course, the fact that “they aren’t making any more land.”

In hindsight, it’s obvious that all these differences were bogus (they’ve never made any more land—except in Dubai, which now has its own problems). At the time, however, with prices going up every day, things sure seemed different.

In fairness to the thousands of experts who’ve snookered themselves throughout the years, a complicating factor is always at work: the ever-present possibility that it really might have been different. Everything is obvious only after the crash.

Consider, for instance, the late 1950s, when a tried-and-true “sell signal” started flashing on Wall Street. For the first time in years, stock prices had risen so high that the dividend yield on stocks had fallen below the coupon yield on bonds. To anyone who had been around for a while, this seemed ridiculous: stocks are riskier than bonds, so a rational buyer must be paid more to own them. Wise, experienced investors sold their stocks and waited for this obvious mispricing to correct itself. They’re still waiting.

Why? Because that time, it was different. There were increasing concerns about inflation, which erodes the value of fixed bond-interest payments. Stocks offer more protection against inflation, so their value relative to bonds had increased. By the time the prudent folks who sold their stocks figured this out, however, they’d missed out on many years of a raging bull market.

When I was on Wall Street, the embryonic Internet sector was different, of course—at least to those of us who were used to buying staid, steady stocks that went up 10 percent in a good year. Most Internet companies didn’t have earnings, and some of them barely had revenue. But the performance of some of their stocks was spectacular.

In 1997, I recommended that my clients buy stock in a company called Yahoo; the stock finished the year up more than 500 percent. The next year, I put a $400-a-share price target on a controversial “online bookseller” called Amazon, worth about $240 a share at the time; within a month, the stock blasted through $400 en route to $600. You don’t have to make too many calls like these before people start listening to you; I soon had a global audience keenly interested in whatever I said.

One of the things I said frequently, especially after my Amazon prediction, was that the tech sector’s stock behavior sure looked like a bubble. At the end of 1998, in fact, I published a report called “Surviving (and Profiting From) Bubble.com,” in which I listed similarities between the dot-com phenomenon and previous boom-and-bust cycles in biotech, personal computers, and other sectors. But I recommended that my clients own a few high-quality Internet stocks anyway—because of the ways in which I thought the Internet was different. I won’t spell out all those ways, but I will say that they sounded less stupid then than they do now.

The bottom line is that resisting the siren call of a boom is much easier when you have already been obliterated by one. In the late 1990s, as stocks kept roaring higher, it got easier and easier to believe that something really was different. So, in early 2000, weeks before the bubble burst, I put a lot of money where my mouth was. Two years later, I had lost the equivalent of six high-end college educations.

Of course, as Eliot Spitzer and others would later observe—and as was crystal clear to most Wall Street executives at the time—being bullish in a bull market is undeniably good for business. When the market is rising, no one wants to work with a bear.

Which brings us to the last major contributor to booms and busts: self-interest.

When people look back on bubbles, many conclude that the participants must have gone stark raving mad. In most cases, nothing could be further from the truth.

In my example from the housing boom, for instance, each participant’s job was not to predict what the housing market would do but to accomplish a more concrete aim. The buyer wanted to buy a house; the real-estate agent wanted to earn a commission; the mortgage broker wanted to sell a loan; Wall Street wanted to buy loans so it could package and resell them as “mortgage-backed securities”; Alan Greenspan wanted to keep American prosperity alive; members of Congress wanted to get reelected. None of these participants, it is important to note, was paid to predict the likely future movements of the housing market. In every case (except, perhaps, the buyer’s), that was, at best, a minor concern.

This does not make the participants villains or morons. It does, however, illustrate another critical component of boom-time decision-making: the difference between investment risk and career or business risk.

Professional fund managers are paid to manage money for their clients. Most managers succeed or fail based not on how much money they make or lose but on how much they make or lose relative to the market and other fund managers.

If the market goes up 20 percent and your Fidelity fund goes up only 10 percent, for example, you probably won’t call Fidelity and say, “Thank you.” Instead, you’ll probably call and say, “What am I paying you people for, anyway?” (Or at least that’s what a lot of investors do.) And if this performance continues for a while, you might eventually fire Fidelity and hire a new fund manager.

On the other hand, if your Fidelity fund declines in value but the market drops even more, you’ll probably stick with the fund for a while (“Hey, at least I didn’t lose as much as all those suckers in index funds”). That is, until the market drops so much that you can’t take it anymore and you sell everything, which is what a lot of people did in October, when the Dow plunged below 9,000.

In the money-management business, therefore, investment risk is the risk that your bets will cost your clients money. Career or business risk, meanwhile, is the risk that your bets will cost you or your firm money or clients.

The tension between investment risk and business risk often leads fund managers to make decisions that, to outsiders, seem bizarre. From the fund managers’ perspective, however, they’re perfectly rational.

In the late 1990s, while I was trying to figure out whether it was different this time, some of the most legendary fund managers in the industry were struggling. Since 1995, any fund managers who had been bearish had not been viewed as “wise” or “prudent”; they had been viewed as “wrong.” And because being wrong meant underperforming, many had been shown the door.

It doesn’t take very many of these firings to wake other financial professionals up to the fact that being bearish and wrong is at least as risky as being bullish and wrong. The ultimate judge of who is “right” and “wrong” on Wall Street, moreover, is the market, which posts its verdict day after day, month after month, year after year. So over time, in a long bull market, most of the bears get weeded out, through either attrition or capitulation.

By mid-1999, with mountains of money being made in tech stocks, fund owners were more impatient than ever: their friends were getting rich in Cisco, so their fund manager had better own Cisco—or he or she was an idiot. And if the fund manager thought Cisco was overvalued and was eventually going to crash? Well, in those years, fund managers usually approached this type of problem in of one of three ways: they refused to play; they played and tried to win; or they split the difference.

In the first camp was an iconic hedge-fund manager named Julian Robertson. For almost two decades, Robertson’s Tiger Management had racked up annual gains of about 30 percent by, as he put it, buying the best stocks and shorting the worst. (One of the worst, in Robertson’s opinion, was Amazon, and he used to summon me to his office and demand to know why everyone else kept buying it.)

By 1998, Robertson was short Amazon and other tech stocks, and by 2000, after the NASDAQ had jumped an astounding 86 percent the previous year, Robertson’s business and reputation had been mauled. Thanks to poor performance and investor withdrawals, Tiger’s assets under management had collapsed from about $20billion to about $6billion, and the firm’s revenues had collapsed as well. Robertson refused to change his stance, however, and in the spring of 2000, he threw in the towel: he closed Tiger’s doors and began returning what was left of his investors’ money.

Across town, meanwhile, at Soros Fund Management, a similar struggle was taking place, with another titanic fund manager’s reputation on the line. In 1998, the firm had gotten crushed as a result of its bets against technology stocks (among other reasons). Midway through 1999, however, the manager of Soros’s Quantum Fund, Stanley Druckenmiller, reversed that position and went long on technology. Why? Because unlike Robertson, Druckenmiller viewed it as his job to make money no matter what the market was doing, not to insist that the market was wrong.

At first, the bet worked: the reversal saved 1999 and got 2000 off to a good start. But by the end of April, Quantum was down a shocking 22 percent for the year, and Druckenmiller had resigned: “We thought it was the eighth inning, and it was the ninth.”

Robertson and Druckenmiller stuck to their guns and played the extremes (and lost). Another fund manager, a man I’ll call the Pragmatist, split the difference.

The Pragmatist had owned tech stocks for most of the 1990s, and their spectacular performance had made his fund famous and his firm rich. By mid-1999, however, the Pragmatist had seen a bust in the making and begun selling tech, so his fund had started to underperform. Just one quarter later, his boss, tired of watching assets flow out the door, suggested that the Pragmatist reconsider his position on tech. A quarter after that, his boss made it simpler for him: buy tech, or you’re fired.

The Pragmatist thought about quitting. But he knew what would happen if he did: his boss would hire a 25-year-old gunslinger who would immediately load up the fund with tech stocks. The Pragmatist also thought about refusing to follow the order. But that would mean he would be fired for cause (no severance or bonus), and his boss would hire the same 25-year-old gunslinger.

In the end, the Pragmatist compromised. He bought enough tech stocks to pacify his boss but not enough to entirely wipe out his fund holders if the tech bubble popped. A few months later, when the market crashed and the fund got hammered, he took his bonus and left the firm.

This tension between investment risk and career or business risk comes into play in other areas of Wall Street too. It was at the center of the decisions made in the past few years by half a dozen seemingly brilliant CEOs whose firms no longer exist.

Why did Bear Stearns, Lehman Brothers, Fannie Mae, Freddie Mac, AIG, and the rest of an ever-growing Wall Street hall of shame take so much risk that they ended up blowing their firms to kingdom come? Because in a bull market, when you borrow and bet $30 for every $1 you have in capital, as many firms did, you can do mind-bogglingly well. And when your competitors are betting the same $30 for every $1, and your shareholders are demanding that you do better, and your bonus is tied to how much money your firm makes—not over the long term, but this year, before December 31—the downside to refusing to ride the bull market comes into sharp relief. And when naysayers have been so wrong for so long, and your risk-management people assure you that you’re in good shape unless we have another Great Depression (which we won’t, of course, because it’s different this time), well, you can easily convince yourself that disaster is a possibility so remote that it’s not even worth thinking about.

It’s easy to lay the destruction of Wall Street at the feet of the CEOs and directors, and the bulk of the responsibility does lie with them. But some of it lies with shareholders and the whole model of public ownership. Wall Street never has been—and likely never will be—paid primarily for capital preservation. However, in the days when Wall Street firms were funded primarily by capital contributed by individual partners, preserving that capital in the long run was understandably a higher priority than it is today. Now Wall Street firms are primarily owned not by partners with personal capital at risk but by demanding institutional shareholders examining short-term results. When your fiduciary duty is to manage the firm for the benefit of your shareholders, you can easily persuade yourself that you’re just balancing risk and reward—when what you’re really doing is betting the firm.

As we work our way through the wreckage of this latest colossal bust, our government—at our urging—will go to great lengths to try to make sure such a bust never happens again. We will “fix” the “problems” that we decide caused the debacle; we will create new regulatory requirements and systems; we will throw a lot of people in jail. We will do whatever we must to assure ourselves that it will be different next time. And as long as the searing memory of this disaster is fresh in the public mind, it will be different. But as the bust recedes into the past, our priorities will slowly change, and we will begin to set ourselves up for the next great boom.

A few decades hence, when the Great Crash of 2008 is a distant memory and the economy is humming along again, our government—at our urging—will begin to weaken many of the regulatory requirements and systems we put in place now. Why? To make our economy more competitive and to unleash the power of our free-market system. We will tell ourselves it’s different, and in many ways, it will be. But the cycle will start all over again.

So what can we learn from all this? In the words of the great investor Jeremy Grantham, who saw this collapse coming and has seen just about everything else in his four-decade career: “We will learn an enormous amount in a very short time, quite a bit in the medium term, and absolutely nothing in the long term.” Of course, to paraphrase Keynes, in the long term, you and I will be dead. Until that time comes, here are three thoughts I hope we all can keep in mind.

First, bubbles are to free-market capitalism as hurricanes are to weather: regular, natural, and unavoidable. They have happened since the dawn of economic history, and they’ll keep happening for as long as humans walk the Earth, no matter how we try to stop them. We can’t legislate away the business cycle, just as we can’t eliminate the self-interest that makes the whole capitalist system work. We would do ourselves a favor if we stopped pretending we can.

Second, bubbles and their aftermaths aren’t all bad: the tech and Internet bubble, for example, helped fund the development of a global medium that will eventually be as central to society as electricity. Likewise, the latest bust will almost certainly lead to a smaller, poorer financial industry, meaning that many talented workers will go instead into other careers—that’s probably a healthy rebalancing for the economy as a whole. The current bust will also lead to at least some regulatory improvements that endure; the carnage of 1933, for example, gave rise to many of our securities laws and to the SEC, without which this bust would have been worse.

Lastly, we who have had the misfortune of learning firsthand from this experience—and in a bust this big, that group includes just about everyone—can take pains to make sure that we, personally, never make similar mistakes again. Specifically, we can save more, spend less, diversify our investments, and avoid buying things we can’t afford. Most of all, a few decades down the road, we can raise an eyebrow when our children explain that we really should get in on the new new new thing because, yes, it’s different this time.

The URL for this page is http://www.theatlantic.com/doc/200812/blodget-wall-street

SUBSCRIBE TO THE ATLANTIC TODAY!

Take advantage of our great rate to subscribe to a year of The Atlantic Monthly.

Go to the following Web address to sign up today:

NY Times Noteable Books of 2008

December 7, 2008

Holiday Books

100 Notable Books of 2008

The Book Review has selected this list from books reviewed since Dec. 2, 2007, when we published our previous Notables list.

Fiction & Poetry

AMERICAN WIFE. By Curtis Sittenfeld. (Random House, $26.) The life of this novel’s heroine — a first lady who comes to realize, at the height of the Iraq war, that she has compromised her youthful ideals — is conspicuously modeled on that of Laura Bush.

ATMOSPHERIC DISTURBANCES. By Rivka Galchen. (Farrar, Straus & Giroux, $24.) The psychiatrist-narrator of this brainy, whimsical first novel believes that his beautiful, much-younger Argentine wife has been replaced by an exact double.

BASS CATHEDRAL. By Nathaniel Mackey. (New Directions, paper, $16.95.) Mackey’s fictive world is an insular one of musicians composing, playing and talking jazz in the private language of their art.

BEAUTIFUL CHILDREN. By Charles Bock. (Random House, $25.) This bravura first novel, set against a corruptly compelling Las Vegas landscape, revolves around the disappearance of a surly 12-year-old boy.

BEIJING COMA. By Ma Jian. Translated by Flora Drew. (Farrar, Straus & Giroux, $27.50.) Ma’s novel, an important political statement, looks at China through the life of a dissident paralyzed at Tiananmen Square.

A BETTER ANGEL: Stories. By Chris Adrian. (Farrar, Straus & Giroux, $23.) For Adrian — who is both a pediatrician and a divinity student — illness and a heightened spiritual state are closely related conditions.

BLACK FLIES. By Shannon Burke. (Soft Skull, paper, $14.95.) A rookie paramedic in New York City is overwhelmed by the horrors of his job in this arresting, confrontational novel, informed by Burke’s five years of experience on city ambulances.

THE BLUE STAR. By Tony Earley. (Little, Brown, $23.99.) The caring, thoughtful hero of Earley’s engrossing first novel, “Jim the Boy,” is now 17 and confronting not only the eternal turmoil of love, but also venality and the frightening calls of duty and war.